Real Property / Costs

Costs: Overview

The Costs application and processes enable you to organize, record, manage, and analyze detailed lease and real property costs. The application provides a wizard interface for entering costs as income or expenses, so that your Cost Administrator can record costs for leases whether your organization is the tenant or the landlord. You can associate costs with leases, buildings, properties, or accounts, so that you can record costs for each of these entities, including costs for buildings that you both own and occupy.

Once your costs are recorded, you can use them to generate reports. For example, you can generate Cash Flow and Costs reports that include summary statistics to help you analyze your cost data. You can also charge back and invoice costs using the Chargeback & Invoicing features.

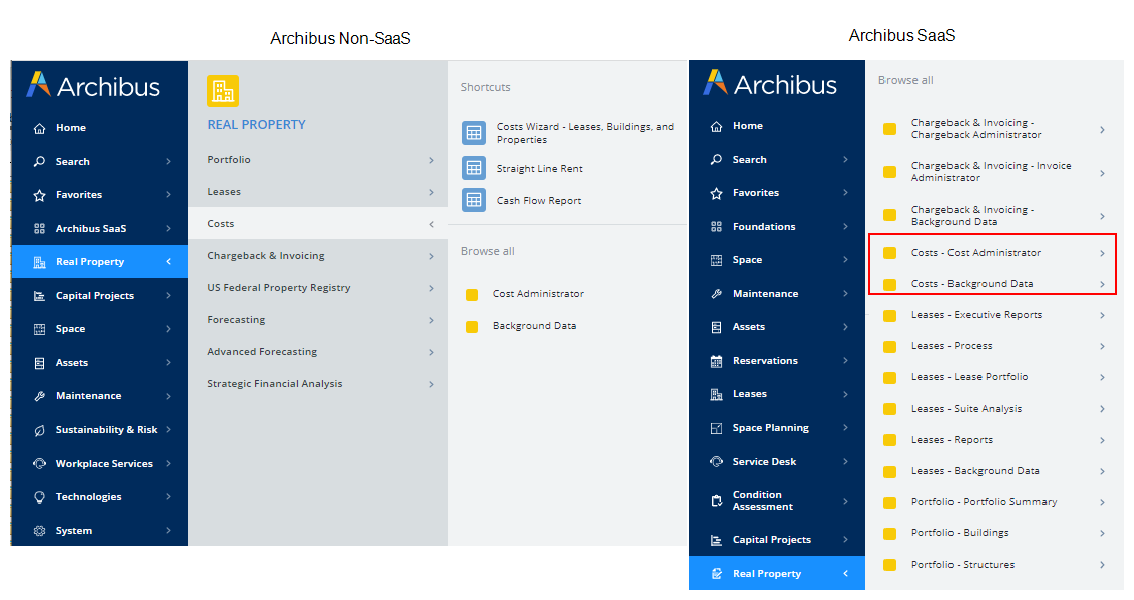

The Costs features are available as a non-SaaS application, and as a series of processes in the Real Estate SaaS module.

Concepts

- Understanding Costs

- Cost Categories

- Lease Indexing

- CAM (Common Area Maintenance) Costs

- Cost Wizard Process

- VAT Cost Types and Currencies for Reports

- Understanding Lease and Property Financial Analysis Reports

Cost Calculations

- Cost Calculations for Lease and Property Reports

- Area Calculations for Lease and Property Reports

- Benchmark Calculations for Lease and Property Reports

Typical Workflow

Before you begin

Prior to using the Costs application, your Lease Administrator or Portfolio Manager develops data for your leases, buildings, properties, and parcels using the Add / Edit tasks of the Leases or Portfolio applications. See Overview: Editing Leases and Portfolio Items.

To track parcels, add parcel for existing properties using the Manage Parcels task or the Portfolio Edit Wizard. See Managing Parcels.

Review the above concepts to determine the features you want to implement. For example:

-

You may wish to start by entering base rents and estimated utility costs as recurring costs; later, you can refine your cost tracking by entering one-time scheduled costs and converting recurring costs to schedule costs, and finally approving them so they are considered actual costs.

-

You may wish to track CAM costs and indexing once basic cost data is established.

Step 1: Develop validating background data.

See Background Data for Costs Application.

Step 2: Enter and manage costs using the Cost Wizard.

You can work with any combination of recurring, scheduled, or actual costs that meets your reporting needs. You can add these costs for properties, parcels, buildings, leases, or accounts.

Note: Actual costs are required if you want to generate chargeback, or issue invoices for the costs. This is done using the Cost Chargeback and Invoicing application.

Step 3: Optionally, track the following:

| Task | Help Topic |

|---|---|

|

Add or review important tax actions for a property or parcel for a specific date range. By searching on the Date Required, you can review any overdue tax actions that may need immediate attention. Add taxes for parcels associated with land. |

|

| Generate indexed rent using any price index and a Lease Indexing Profile. | Lease Indexing: Overview |

| For current FASB-13 compliance, generate the Straight-Line Rent report that calculates and compares straight-line rent adjustments with actual rent differential analysis. | Straight-Line Rent Report |

|

Generate CAM estimates based on a CAM Profile, and reconcile CAM costs. The CAM Reconciliation report enables both landlord and tenant cost administrators to analyze CAM cost performance. |

Managing Common Area Maintenance Costs (CAM) |

Step 4: Review and analyze costs, compare portfolio items using benchmark reports, or analyze a high-level summary of your costs.

See Costs Reports.

Using the Archibus Enhanced Global Feature Set

If you are using the Archibus Enhanced Global Feature Set, you add costs for your leases, building, properties or accounts using the Cost Wizard, just as is done when these features are not enabled. However, when the Archibus Enhanced Global Feature Set are enabled there are additional fields to work with. These fields enable you to view the breakdown for Base Costs (without VAT), VAT costs, and Total Costs in the Payment Currency or Budget Currency.

If you are using the Archibus Enhanced Global Feature Set, you perform these additional tasks:

For more information, see:

- Archibus Enhanced Global Feature Set (Multi-currency and VAT)

- Using the Archibus Enhanced Global Feature Set in Real Property

- Working with the Enhanced Global Feature Set Overview

- Working with the Cost Wizard When Using the Archibus Enhanced Global Feature Set