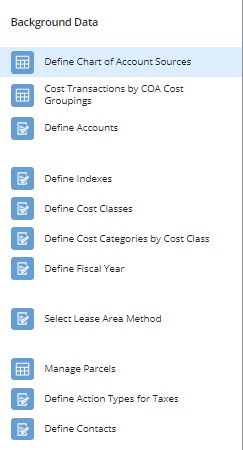

Real Property / Costs / Background Data

Background Data for Costs Application

Define the following background data for the Costs application. You only need to define the tables for the features you want to take advantage of. For example, if you do not want to use indexing, do not complete the Define Indexes task.

| Task | Description |

|---|---|

| Define Chart of Account Sources | A chart of accounts (COA) is a financial organizational tool that provides a complete listing of every account in an accounting system. COA groupings map to general ledger entries. If you have an existing COA and wish to track your lease costs by these groupings, use this task to enter your COA. |

| Cost Transactions by COA Cost Groupings | If you are tracking costs by COA, Use this task to review your costs by COA groupings. |

| Define Accounts |

Define accounts, so that Cost Administrators can associate costs with them. Accounts can be internal to your organization, or external companies to which you pay or receive funds. Accounts can be associated with Chart of Account Groupings, so that the Total Cost of Ownership can be calculated. |

| Define Indexes |

|

| Define Cost Classes | Cost categories are associated with cost classes. You can search for costs by cost class when managing costs using the Cost Wizard, and when selecting costs to report on. |

| Define Cost Categories by Class | Cost categories are used for grouping and summarizing costs for cost reporting, cash flow, and chargeback. Cost categories are associated with cost classes and can optionally be associated with super classes that roll up cost categories to more general groupings. All costs must be associated with a cost category. |

| Define Fiscal Year | Enter your company's fiscal year start date. |

| Select Lease Area Method: |

Select the lease area method that informs the system how to assign physical floor areas to particular leases. The Lease Area Method is used:

|

| Manage Parcels | You can track parcels associated with your land. These parcels are then available for cost administrators to record tax costs for the property. |

| Define Action Types for Tax | Enter additional Activity Types for property taxes. |

| Define Contacts | Define contacts relevant to your costs, such as Tax Authority or Tax Collector contacts. |

You may also need to perform these tasks:

- If you have defined additional cost categories for base rent, enter alternate names for the RENT - BASE RENT Cost Category. See Entering Alternate Name for the RENT - BASE RENT Cost Category.

- Enter alternative names for the RENT - CAM ESTIMATE and RENT - CAM RECONCILIATION cost categories. See Entering Alternate Names for the CAM Cost Categories.

See Also