Real Property / Leases / Lease Portfolio / Lease Classification Wizard

Classifying a Lease: Step 1

Prerequisites

- Leases to be classified should have values for the following fields. Use the Real Property / Leases / Lease Portfolio Console view to complete these fields.

- Lease End Date

- Lease Start Date

- Load the Lease Classification Wizard and select a lease.

Procedure

- For each lease, you must set the FASB/IASB Lease Type field. You may have already set this when defining the lease. You can change the current value as necessary.

| FASB/IASB Lease Type | Description |

|---|---|

| Pending | If you are not sure of the lease type, set this value. Before you edit this field, this is the default value. |

| Land Only |

It is possible that a lease covers land only, and not buildings. For example:

|

| Partial-Building | You are leasing the entire building or part of the building, but not the land. For example, you are leasing all the space in a building or are leasing one floor in a high-rise building. |

| Building and Land | You are leasing both the building and the land. For example, you lease floors in the building and parking spaces on the land. |

| Equipment | You are leasing equipment. For example, you might be leasing vehicles for employee travel, expensive computer equipment, or machinery. |

| IASB Building or Land | You are leasing both and following IASB conventions. |

| IASB Equipment | You are leasing equipment and following IASB conventions. |

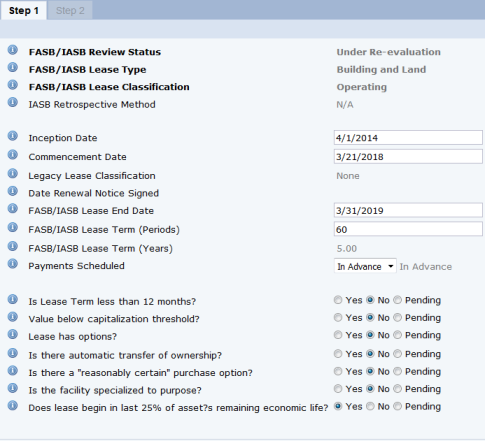

- On the Step 1 tab, the wizard presents a series of fields that are required for lease classification. For general information on using this Wizard, see Working with the Lease Classification Wizard.

- Complete the fields as follows.

- Modified Option 1 ROU -- ROU Asset Value Is calculated from the original lease Start Date, but the Incremental Borrowing Rate is chosen as appropriate at the time of transition.

- Modified Option 2 ILL -- ROU Asset Value Is calculated to be equal to the remaining Lease Liability

- IAS 17 - Operating

- IAS 17- Finance

- ASC 840 - Operating

- ASC 840 - Capital

-

If the organization has adopted the ASC 842 "package of practical expedients" they do not need to reclassify legacy leases. For this situation, set the

AbRPLMLeaseAdministration-FASB842_UsePracticalExpedientsapplication parameter to Yes. - For ASC 840 leases, the program calculates both the previous amortization schedule under ASC 840 as well as the new schedule under AC 842 rules.

- For IAS 17 leases, the program calculates the Retrospective Method (Full, Modified Option 1, or Modified Option 2) schedule as selected by the lease accountant and the application parameter.

- If the lease has already been classified (FASB/IASB Review Status is not Pending) , the Wizard shows the existing classification, such as FASB 840 - Operating. The field is not editable.

- If the lease has never been classified (the FASB/IASB Review Status is Pending) and if the Lease Start Date is after the Effective Date, then the Wizard shows None and the field is not editable.

- The Lease End Date (end_date) – that is the end of the lease contract

- The last Date Due of any Cost, Scheduled Cost or Recurring Cost that is assigned to this lease and that has one of the

CostCategory_FASB842categories (Base Rent, Initial Direct Costs, Lease Improvements, Other Amortized Costs). This involves projecting the Recurring Costs. - The last Date Exercising Applicable of any option assigned to the lease that has "Is Reasonably Certain?" set to Yes.

- the first fiscal period in this classification or re-evaluation – namely the one that includes the Commencement Date (date_commencement)

- the last fiscal period – namely the one that includes the FASB Lease End Date (date_end_fasb)

- The lease payment is booked on the last day of the period (e.g. 2020-12-31 for a yearly lease)

- The first period interest is the value of the Initial Lease Liability times the Internal Borrowing rate (e.g. $300,000 times %9.15 = $27,450).

- The first period interest is booked on the first day of the period (e.g. 2020-01-01)

- The Lease Payment is booked on the first day of the period (e.g. 2020-01-01 for a yearly lease)

- The first period interest is (the value of the Initial Lease Liability minus the first Lease Payment) times the Internal Borrowing rate (e.g. $300,000 - $100,000 times %9.15 = $18,300). That is to say, the organization is not “borrowing” the amount of the first Lease Payment.

- The first period interest is booked on the last day of the period (e.g. 2020-12-31). That is to say, the first period’s interest covers the Lease Liability starting with the second period. The interest for the last period is 0.0.

- If the lease has an option of type OPTION TO BUY that has "Is Reasonably Certain?" set to No, then the Wizard sets the value for this field to No.

- If the lease has an option of type OPTION TO BUY that has "Is Reasonably Certain?" set to Yes, then the Wizard sets the value for this field to Yes.

- When through responding to questions on the Step 1 tab, click the STEP 1 DONE button. (If you are working with a land-only lease, the button is labeled MARK AS DONE.)

- The system calculates the amortization schedule using the default Incremental Borrowing Rate (IBR) and updates values for the fields, completing the

ls.class_wiz_step1_donefield. You can access the generated amortization schedule report using the Amortization button in the upper right corner. - The system moves you to the Step 2 tab so that you can continue to classify the lease.

- The system calculates the amortization schedule using the default Incremental Borrowing Rate (IBR) and updates values for the fields, completing the

| Field Title | Field | Description |

|---|---|---|

| FASB/IASB Lease Type | ls.fasb_ls_type |

If you previously set this value when defining a lease, the system presents it and no further action is required. If you have not previously set this value, the Wizard sets it to Pending. You can change this value if necessary. See above Step 1 discussion for a description of the options. |

| IASB Retrospective Method | ls.iasb_retro_method |

If you have set FASB/IASB Lease Type to "IASB Building or Land" or " IASB Equipment" and if If the Application Parameter This field applies only to IASB leases. Therefore, if the FASB/IASB Lease Type is not "IASB Building or Land' or "IASB Equipment," then the Wizard sets this value to "N/A." For more information on retrospective methods, see Concept: IASB Retrospective Approaches. |

| Inception Date | ls.date_inception |

If available in the Leases table, the Wizard completes this field with the existing value. You can edit this value if necessary. If this value is not stored in the Leases table, edit this field to enter the date that you agreed to the principles of the lease. |

| Commencement Date | ls.date_commencement |

This is the date at which a lessee should initially classify, recognize, and measure lease-related assets and liabilities (except if applying the short-term lease exemption); that is, the date that the lessor makes the underlying assets available for use by the lessee Depending on the Review Status, the Lease Type, and the IASB Retrospective method, the Wizard completes this field with information from the lease. You can edit this value if necessary. |

| Legacy Lease Classification | ls.fasb_ls_legacy |

Use this field to record the lease's classification under the previous guidance (IAS IFRS 17 or FASB ASC 840). If the field is editable and you have an "IASB Equipment" and "IASB Building or Land" lease, choose from: For other leases, choose from: It is important to complete this field because if the lease was already classified under a previous guidance (ASC 840 or IAS 17), then the program makes additional calculations to support transition accounting: The Legacy Lease Classification field is not editable in these situations: |

| Date Renewal Notice Signed | ls.op.date_renewal_signed | The system completes this with the date that you signed an option to renew the lease. |

| FASB/IASB Lease End Date | ls.date_end_fasb |

Includes the term of the lease as well as the term of any options that are reasonably likely to be executed. The wizard calculates this as the reasonably certain term of the lease. This is the greatest of: |

| FASB/IASB Lease Term (Periods) | ls.lease_term_per |

The system calculates this field, but you can override the calculated value. This is the number of periods (typically months) including and between: For instance, a 5-year, monthly lease with three years left on it would have 36 periods. |

| FASB/IASB Lease Term (Years) | ls. lease_term |

The Wizard calculates this by dividing the FASB/IASB Lease Term (Periods) by 1, 4 or 12 depending on whether the lease period is monthly, quarterly or yearly. This value is not editable. Note that this is reasonably certain time frame used for accounting, not the exact term specified in the lease contract. |

| Payments Scheduled |

You can choose In Advance, or In Arrears to indicate when you pay the lease, which is important for determining if you pay the interest on the first period. If a lease is paid in advance, you do not accrue interest on the lease liability for the first fiscal period for the lease. For a lease that is paid in arrears: For a lease that is paid in advance: |

|

| Is Lease Term less than 12 months? | ls.is_short_term_lease |

If the Lease Term (the total lease term, not the FASB/IASB lease term) is less than 12 months, and there is not a reasonably certain purchase option, then the Wizard sets this value to Yes. The lease is considered to be a short-term lease and therefore is classified as an operating lease. You can change the value that the Wizard sets. |

| Value below capitalization threshold? | ls.below_cap_threshold |

The Wizard does not automatically set this value. The lease administrator must set this value to Yes or No. The threshold is typically $5,000.00. This field helps you identify "low-value" leases which do not need to be capitalized. |

| Lease has options? | ls.has_options |

If this lease has any assigned Option records that are reasonably certain to be executed, the Wizard sets this option to Yes. For IASB, the test is whether or not the lease has any options (not just options that are “reasonably certain” to be executed). You can override the value that the Wizard sets; for example, you can set this No if you determine that the option has no material effect on the ROU Asset value. |

| Is residual value not determinable? | ls.is_residual_unknown |

Residual value refers to a lease provision requiring the lessee to make up a deficiency that is attributable to damage, extraordinary wear and tear, or excessive usage. If you set this to Yes, the system informs you that the lease does not require capitalization. At the top of the form, the Wizard sets Lease Classification to Operating. The Wizard can later change this value based on other questions that you answer. This option is available only for leases with a Lease Type of Partial-Building |

|

Is there automatic transfer of ownership? |

ls.is_auto_transfer |

Set this to Yes if the tenant will take ownership of the leased asset at the end of the lease. If set to Yes, the Wizard informs you that this is a finance lease and requires capitalization. At the top of the form, the Wizard sets Lease Classification to Finance. The Wizard can later change this value based on other questions that you answer. If the lease has an option of type AUTOMATIC TRANSFER OF OWNERSHIP that has "Is Reasonably Certain?" set to Yes, the value of this field defaults to Yes on new records. |

| Is there a reasonably certain purchase option? | ls.is_purchase_option |

Set this to Yes if it is likely that the tenant will purchase the leased asset. If set to Yes, the Wizard informs you that this is a finance lease and requires capitalization. At the top of the form, the Wizard sets Lease Classification to Finance. The Wizard can later change this value based on other questions that you answer. The Wizard automatically sets the value of this field in these circumstances: |

| Is the facility specialized to purpose? | ls.is_facility_specialized |

Set this to Yes if the leased asset is so specialized that only the lessee can use it without major modifications. In other words, the owner expects that no one else can rent this space or equipment item without modification. When this option is set to Yes, the Wizard informs you that this is a finance lease. At the top of the form, the Wizard sets Lease Classification to Finance. The Wizard can later change this value based on other questions that you answer. |

| Does the lease begin in the last 25 percent of the asset's remaining economic life? | ls.is_lease_near_eol |

If the leased asset has less than 25 percent of its remaining economic life, the Wizard will classify this as a finance lease. For example, a 4-year lease of an asset with a 5-year useful life would be classified as a finance lease. This is known as useful-life. The Wizard sets this value to Yes or No by running the below calculation, but you can change this setting if necessary. Calculated based on Building Age (Date Built as of Commencement Date) to see if Age exceeds building end of life. For example, if the building is 39 years old:

This question does not apply to leases for equipment. |

Next

On the Step 2 tab you will see calculations that the Wizard made when it calculated the amortization schedule using the information entered on the Step 1 tab.