Real Property / Leases / Lease Portfolio / Lease Classification Wizard

Classifying a Lease: Step 2

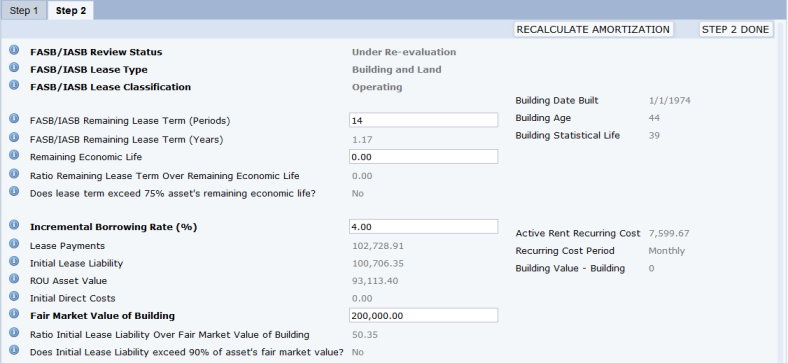

If you worked through Step 1 tab and the Wizard determined that you do not have an operating lease, the Wizard moves you to the Step 2 tab so that you can provide additional information about your lease.

When working with Step 2 tab, note that in some cases, the system calculates and presents a value based on existing data about the lease or information that you completed on the Step 1 tab. You can overwrite some of the generated value if needed. For example, you may want to account for a situation that you know about and that is not reflected in the values that the calculations examine. The values for these options determine whether a lease is classified as operating or finance, so carefully examine any values that you choose to overwrite.

For general information on using the Wizard, see Working with the Lease Classification Wizard.

Step 1: Review the Calculated Fields

At the top of the Step 2 form, you can see the values that the Wizard calculated when you chose the STEP 1 DONE button on the Step 1 tab. You can edit some of these values if necessary.

| Field Heading | Field | Explanation | Editable? | Calculated Value |

|---|---|---|---|---|

| FASB/IASB Remaining Lease Term (Periods) | ls.lease_term_per |

A 5 year, monthly lease with three years left on it would have 36 periods. |

The system calculated the value based on the responses on the Step 1 tab. You can edit this if necessary. |

This is the number of periods including and between:

|

| FASB/IASB Remaining Lease Term (Years) | ls.lease_term_remain | The remaining years of the lease until its end date. | Not editable |

Divide the FASB/IASB Lease Term (Periods) by 1, 4 or 12 depending on whether the lease period is monthly, quarterly or yearly. |

| Depreciation Period (Years) | lease_deprec_per |

The number of units of time over which the cost of the asset is allocated. The Wizard displays this only for Equipment leases. |

You may need to edit the default value if the equipment is being depreciated on a different schedule than the lease. |

The Wizard displays the same value as found in the FASB/IASB Remaining Lease Term field. |

| Remaining Economic Life | ls.remaining_life_bldg | The period over which an asset is expected to be economically usable by one or more users. | The system calculates the value based on the responses in the Step 1 tab. You can edit this value. |

|

| Ratio Lease Term Over Remaining Economic Life | ls.pct_term_over_life | Remaining Lease Term divided by Remaining Economic Life | Not editable. |

Note: If the lease commencement date falls at or near the end of the economic life of the underlying asset, the Wizard does not consider this criterion when determining a finance lease. Thus, if Building Age exceeds or is near end of Building Status Life (39 years x 75% = 29.25 years); the system does not calculate Ratio Lease Term over Remaining Economic Life. Instead, it sets Ratio Lease Term Over Remaining Economic Life to 0.00. |

| Does lease term exceed 75 percent of asset's remaining life? | ls.is_term_exceed_life |

The Wizard sets this field, but it is editable. If you know of other circumstances that will affect the calculation, you can change the value that the Wizard provided. |

The Wizard sets this to Yes or No depending on the values the above calculations. |

Step 2: Complete the Step 2 Form

In the bottom section of the Step 2 form, you can enter and review additional fields.

Note: Some fields have separate calculations for equipment and building assets. When reviewing the below table, note that some field names, such as ls.remaining_life_bldg, include bldg in their name; however, they hold values for both equipment and building leases.

Note: At any time while working on the Step 2 tab, you can recalculate the amortization schedule by choosing the RECALCULATE AMORTIZATION button. This recalculates the amortization schedule and updates the Lease Payments, Initial Lease Liability, ROU Asset Value, and Initial Direct Costs fields.

Note: When working with equipment leases, you must enter the Market Value and the Residual Value as non-zero numbers before the Wizard enables the Step 2 Done button . The wizard needs these values to calculate the rate implicit in the lease, which you need to compare to your internal borrowing rate to make sure your internal borrowing rate is correct.

| Field Heading | Field | Explanation | Editable? |

|---|---|---|---|

| Incremental Borrowing Rate (%) | ls.increm_borrow_rate |

This is the cost of capital assumed for the lease calculations: the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term on an amount equal to the lease payments in a similar economic environment. Some organizations use different Incremental Borrowing Rates for different types of assets (e.g. types of equipment, buildings, land) based on the different risks associated with loans on each type of assets. |

Enter the expected borrowing rate. When you complete the Step 1 tab and the Wizard calculates the amortization rate, it uses the default value defined in the If you change this value, you should recalculate the amortization schedule by choosing the RECALCULATE AMORTIZATION button. This updates the Lease Payments, Initial Lease Liability, ROU Asset Value, and Initial Direct Costs fields that are displayed on the Step 2 tab. |

| Rate Implicit in Lease | lease_implicit_rate |

For Equipment leases only. The implicit rate is the borrowing rate that can be imputed from the market value of the leased asset, the schedule of lease payments, and the residual value of the leased asset. Under FASB ASC 842 and IRFS 16 guidance, organizations are required to use the implicit rate as the Internal Borrowing Rate if this implicit rate is higher than the rate at which the organization can borrow money for that asset type. In practical terms, this condition only occurs with leases on equipment, which can depreciate rapidly in comparison with the term of the loan. |

This field is not editable. The Wizard initially sets this to zero. If you enter a Fair Market Value and a Residual value, the Wizard recalculates the Rate Implicit in Lease as the Internal Rate of Return (IRR) for the lease on an annual basis. |

| Lease Payments | ls.lease_payments | The total lease payments for each year between the current date and the end of the lease, plus the cost of reasonably certain right-of-use options. | If you have not tracked lease costs, you can enter the lease payments that you will make between the current date and the end of the lease. |

| Initial Lease Liability | initial_lease_liability |

The Initial Lease Liability (ILL) is the projected cost of all BASE RENT% Costs for the lease totaled over the entire term of the lease. It is equal to the sum of all Net Rent (Cash Payment) fields for all years of the lease. This is the present value of the lease_payments plus the option_costs. |

This is not editable. |

| ROU Asset Value |

A cost projection of all Lease Costs that are material to FASB recognition on the same period as the amortization. This is the initial direct costs, plus all Costs, Scheduled Costs and Recurring Costs assigned to the current lease that have one of these Cost Categories:

|

This is not editable. | |

| Initial Indirect Costs | ls.initial_direct_cost |

This is all Costs, Scheduled Costs and Recurring Costs assigned to the current lease that have a Cost Category of: This is added to the ROU asset value. |

This is not editable. |

|

Fair Market Value of Building

|

ls.value_bldg | The price that would be received to sell an asset or paid to transfer a liability. For buildings, the Fair Market Value reflects the building only. Lease capitalization does not include the value of the property land. | If the Fair Market Value does not exist in the Equipment or Buildings table so that the system can run the calculation, the Wizard sets this value to zero so that you can enter your own value. |

| Fair Market Value | ls.value_bldg | For equipment leases, this field displays as "Fair Market Value." |

If the Fair Market Value does not exist in the Equipment or Buildings table so that the system can run the calculation, the Wizard sets this value to zero so that you can enter your own value. Note that for equipment leases, you must edit this field in order for the Wizard to activate the STEP 2 DONE button. |

| Residual Value | lease_residual_value |

For equipment leases, this is the full estimated market value of the asset at the end of the lease.

|

You can edit this value. Note that you must edit this field in order for the Wizard to activate the STEP 2 DONE button. |

| Ratio of Initial Lease Liability Over Fair Market Value of Asset | ls.pct_liability_over_fmv | Initial Lease Liability divided by Fair Market Value | Not editable. |

| Does initial lease liability exceed 90 percent of asset's fair market value? | ls.is_npv_exceed_90_fmv | When the system calculates the Ratio of Initial Liability Over Fair Market Value of the Asset, it sets this value to Yes or No. |

If you know of circumstances that will affect the initial lease liability or the fair market value, you can set the value yourself. |

Step 3: Process the Step 2 Form

When through responding to questions on Step 2, click the STEP 2 DONE button. The Wizard recalculates the amortization schedule.

- If your responses indicate that you have an operating lease, no further tasks are needed. The Wizard:

- sets FASB/IASB Review Status to Pending

- sets FASB/IASB Lease Classification to Operating

- updates the form with these values

- presents the SUBMIT for APPROVAL and RESTART WIZARD buttons.

- If you want to edit any of the information, choose the RESTART WIZARD button. The Wizard returns you to the Step 1 tab.

- Otherwise,route the classification for approval using the SUBMIT FOR APPROVAL button.

- If your responses indicate that you have a finance lease, the Wizard:

- sets the FASB/IASB Lease Classification value to Finance and updates the form with this value.

- moves you to the Step 3 tab so that you can complete a series of extra questions about right-of-use options; updating your right-of-use options may change your lease classification from finance to operating.