Archibus SaaS / Leases / Lease Reports

Real Property / Leases / Reports

Property Abstract Report

The Property Abstract report presents a high-level summary of your property portfolio and details for each property included in the report. The report provides book and market value, summarized building and lease areas, summarized expenses and income for each property, and totals for these amounts for all properties included in the report.

You can use the Property Abstract report to obtain key data about your properties:

- Buy or sell? The Property Abstract report helps you decide whether to sell or to keep a property, and to locate any anomalies in your portfolio, such a properties with higher than average expenses.

- Summarized information. Property Abstract reports are valuable for summarizing fundamental property information, including its owners, tenants, amenities, assessed value, costs, and areas

- For both brokers and portfolio managers. Property managers administering properties owned by the company, as well as brokers presenting properties to potential occupants can use the Property Abstract report as it succinctly summarizes the many aspects of a property.

-

Tax rate summaries. Property managers can review the most recent property tax rates by selecting the Update Property Tax Rate option in the filter. (You must first choose to show more options.)

- Only actual cost records are used.

- These calculations are aggregated from the parcel to the property level. The calculations take into account the most recently paid tax costs.

- The report includes the Property Tax Reassessment Evaluation summary information at the property level, and a list of parcels assigned to a property.

- For both brokers and portfolio managers. Property managers administering properties owned by the company, as well as brokers presenting properties to potential occupants can use the Property Abstract report as it succinctly summarizes the many aspects of a property.

Having these reports available improves decision-making, ensures that properties are managed as effectively as possible, and provides easy comparison of properties.

This topic includes the following sections:

- Restricting and Viewing Report Data

- Property Abstract Report Calculations

- The Property Abstract Report Tax Calculations

- Property Abstract Report when Using the Archibus Enhanced Global Feature Set

Restricting and Viewing Report Data

Procedure

To work with the report:

- In the top pane, set the filter and choose the type of costs to include in the report.

- Click the Process and Show button. The report calculates the costs and displays the property records in the bottom pane.

- Click the Details button for a particular property. The Details tab displays the Property Abstract report for this property.

- As necessary, return to the Property Abstract Overview tab to choose another property.

The Property Abstract report presents its information on the following tabs from which you can set a restriction and view report data:

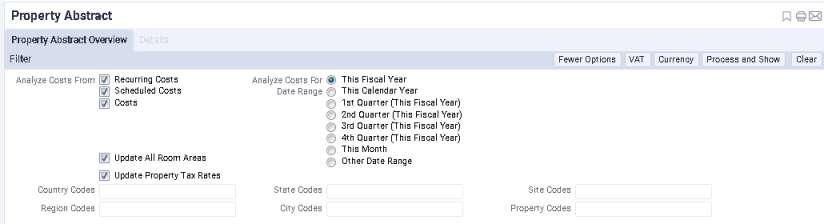

Property Abstract Overview tab

Use the Property Abstract Overview tab to control the data of your property abstract report.

- Includes a Filter console so you can set restrictions that determine the costs and locations included in the report. For example, using the Filter console, you can specify the types of costs to examine (recurring, scheduled, actual, or a combination), as well as the time frame for which to analyze these costs. In the Leases module, you work only with recurring costs.

- When reviewing the financial reports, be sure to consider how the Filter console was completed. See Understanding Financial Analysis Reports for more information on how costs are selected.

Note: To set a custom date range, Select Other Date Range, and then enter a Start and End Date.

See Restricting Data Using a Filter Console for more information on using filter consoles.

- Once you complete the filter, choose Process and Show to update the costs. These display in the Total Costs panel beneath the filter. This provides information for each property, and includes summarized expenses and income, market and book values, purchase price, and summarized building areas for each property. See Property Abstract Report Calculations for details on the summarized expenses and income.

- Once you generate the costs, you can export the information on this tab as a paginated report (DOCX file) using the Report button, and export the data to Excel using the XLS button. These buttons are located on the Total Costs panel.

- For information on Update All Room Areas, see the Property Abstract Report Calculations later in this topic.

- For information on Update Property Tax Rates, see Tax Calculations section later in this topic.

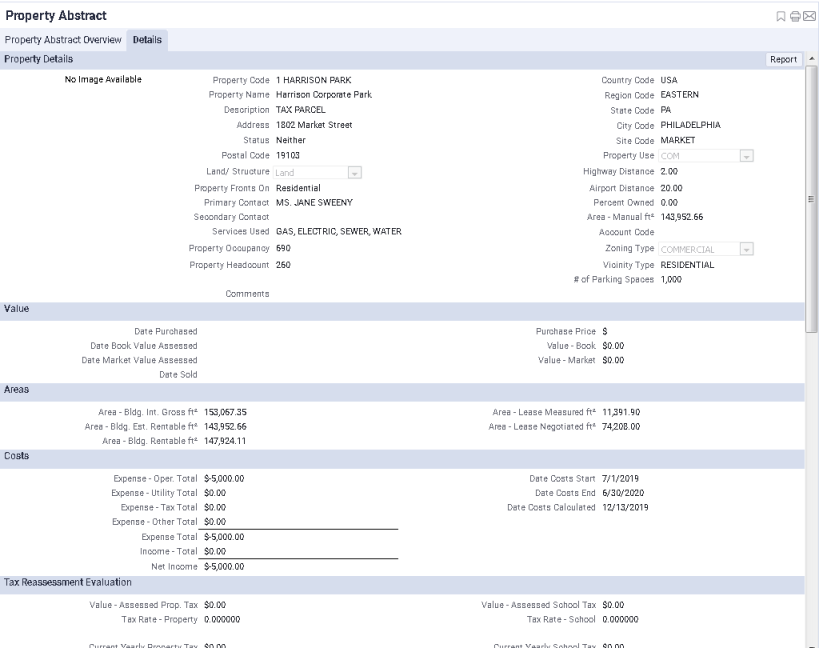

Details tab

After you generate the costs using the Process and Show button, the system displays property records in the bottom pane.

Click the Details button for a property and its abstract report displays in the Details tab. You can now examine details for the property and its associated leases, including amenities, property occupancy, primary contact, and purchase price. Use the Report button to generate a paginated report for the selected property. The report includes a photo if one has been added for the property.

Property Abstract Report Calculations

The Property Abstract report includes several types of calculated fields:

| Field | Description |

|---|---|

| Property Cost Calculations |

The Property Abstract report includes calculated fields based on the cost records entered for the property.

|

| Property Areas |

These are summarized from the property's buildings (the property's Area - Bldg. Rentable, Area - Bldg. Int. Gross, and Area - Bldg. Est. Rentable). The building areas used for these calculations are based on a CAD building performance inventory. See Property Area Based on a Building Performance CAD Inventory for the calculations used. You can select Update Room Areas (in the More Options section) if you want to recalculate the room areas as part of generating the report. Choose this option is you suspect that there have been changes to area values. Note: The measured areas based on a building performance CAD inventory are calculated when the Update Area Totals action is run from one of the processes for the Space Inventory application or Space module, such as the Building Performance process. If your CAD specialist has made recent changes to your measured areas, ask your space manager or facility manager to run the Update Area Totals task so that these area changes are reflected in the reports of the Leases, Portfolio, and Costs applications. Additionally, some reports (such as Lease Abstract and Property Abstract) offer the Update All Room Area action (which runs these same calculations) from the report. For information on this action, see Update Room Areas. |

| Lease measured area | Summarize the area that can be charged for (Area - Lease Measured). See Lease Measured Areas |

| Lease negotiated area | Summed for all leases associated with the property (Area - Lease Negotiated). See Lease Negotiated Areas |

| Property Headcount | Sum of the Building Occupancy value entered for each building assigned to the property. You enter the Building Occupancy using the Portfolio Edit Wizard. |

| Occupancy Rate for each building | The occupancy rate is shown in the Buildings panel on the Details tab. It describes how well-utilized the building is in terms of housing personnel. See the Building Benchmarks section of the Benchmark Calculations for Reports topic for the calculation. |

Note: Area - Bldg. Est. Rentable, Property Occupancy, and # of Parking Spaces are not calculated fields. You manually enter these values when adding information for a property (land) using the Portfolio Edit Wizard.

The Property Abstract Report Tax Calculations

The following fields from the Properties table are updated using the “Update Property Tax Rates” action in the Property Abstract report. For each property, the tax rates and assessed values are determined by summing the tax rates and assessed values from all parcels assigned to the property. These calculations use the most recent property tax rates, and use the latest paid actual costs.

The following fields are calculated:

- Value - Assessed Prop. Tax

- Tax Rate - Property

- Value - Assessed School Tax

- Tax Rate - School

Note the following about these calculations:

- Parcel rates and values are determined from the last paid actual cost transactions representing a tax bill of the appropriate Tax Type (SCHOOL or PROPERTY) for each parcel in the property.

- For each parcel code in the property, these are actual costs of cost categories with cost type = ‘TAX’, where Tax Type is either ‘SCHOOL’ or ‘PROPERTY,’ and these costs have the most recent Date Paid (Max of cost_tran.date_paid). The action ignores Cost records with a Cost Type of N/A.

- For each parcel, the assessed value is determined directly from the recorded Tax Assessed Value in that cost record. (The parcel value is not recorded in the Properties table; only the sum of the property’s parcels tax assessed values are updated in the Properties table).

- Protecting from errors caused by dividing by zero : For any calculations done in Archibus, the application protects against dividing-by-zero errors by replacing parameters that equal 0 with a very LARGE number if the parameter is used as a divisor. For example, if the Value - Assessed Tax = 0 for all the property tax costs associated to the property, then the True Assessed Value = 0 and thus the Tax Rate should = 0.

- Thus,

- {Yearly Tax Cost} / 0 instead becomes: {Yearly Tax Cost} / 99999999999999

- The result becomes a very SMALL number, which becomes 0 when rounded, instead of a very large number.

For each parcel, the tax rate SCHOOL or PROPERTY (depending on cost’s tax type) is determined as follows:

- True Assessed Value = tax_value_assessed / tax_clr Where:

- tax_clr is the Tax Common Level Ratio recorded in the cost record

- tax_value_assessed is the value recorded in the cost record

Where

- tax_clr is the Tax Common Level Ratio recorded in the cost record and

- tax_value_assessed is the value recorded in the cost record (Tax Value - Assessed field)

- Yearly Tax Paid = ( tax_period_in_months / 12 ) * amount_expense

- Tax Rate % = Yearly Tax Paid / True Assessed Value

- Value – Assessed % Tax = sum of Tax Value Assessed (tax_value_assessed) in the cost records.

- % = School or Property, based on Tax Type.

Note: As with the assessed value, the parcel value is not recorded in the Properties table; only the sum of the property’s parcels tax assessed values are updated in the Properties table.)

The following are virtual (calculated) fields:

| Virtual Field | Calculation |

|---|---|

|

Current Yearly Property Tax |

Current Yearly Property Tax = "Tax Rate - Property" times "Value - Assessed Prop. Tax" (property.tax_rate_prop * property.value_assessed_prop_tax) |

|

Estimated Yearly Property Tax |

Estimated Yearly Property Tax = "Tax Rate - Property" x "Value - Market" (property.tax_rate_prop * property.value_market) |

|

Reassessment Savings - Prop |

Reassessment Savings - Prop = "Tax Rate - Property" times (Value - Assessed Prop. Tax minus Value - Market) property.tax_rate_prop * (property.value_assessed_prop_tax - property.value_market ) |

|

Current Yearly School Tax |

Current Yearly School Tax = "Tax Rate - School" times "Value - Assessed School Tax" (property.tax_rate_school * property.value_assessed_school_tax) |

|

Estimated Yearly School Tax |

Estimated Yearly School Tax = 'Tax Rate - School' times "Value - Market" (property.tax_rate_school times Value - Market) |

|

Reassessment Savings - School |

Reassessment Savings - School = "Tax Rate - School" times (Value - Assessed School Tax minus Value - Market) (property.tax_rate_school * (property.value_assessed_school_tax - property.value_market ) |

Property Abstract Report when Using the Archibus Enhanced Global Feature Set

When the Archibus Enhanced Global Feature Set are enabled, you can generate the Property Abstract report to show Total Costs, Base Costs, or VAT Costs using the currency you select. Just as when the Archibus Enhanced Global Feature Set are not enabled, the Property Abstract report calculates operating costs, taxes, utilities, and other expenses as a net income (income - expenses) value for each cost category's cost type. However, when the VAT and multicurrency fields are enabled, the report shows this net amount as Total Costs, Base Costs, or VAT Costs depending on the selections you make to generate the report. See Selecting VAT Cost Types and Currency for Reports for a description of the cost fields used to show VAT costs in different currencies.

Differences between Costs on the Overview tab and the Details tab

When you have enabled the Archibus Enhanced Global Feature Set, note the following differences between the costs shown on the Overview tab and on the Details tab of the Lease Benchmark, Property and Building Benchmark, Property/Building/Lease Abstract, or the Rent Roll reports:

| Issue | Description |

|---|---|

| VAT Cost types | The Overview tab shows costs using the VAT cost type you select. Using the VAT button, you can select to view Total Costs, VAT Only, or Base Costs. The Details tab always shows Total Costs, no matter what selections you make using the VAT button |

| Exchange rate type | When you first generate the report, for the Overview tab, the application converts costs from their payment currency to the display currency using the exchange rate type associated with the display currency (this can be either the payment or budget exchange rate type). The Details tab always shows costs using the budget exchange rate type, regardless of the exchange rate type selection made using the Currency button. For this reason, depending on your selections, different exchange rate types might have been used for the costs, and this can contribute to a difference between the costs shown on each tab |

| Effects of rounding | The costs shown on the Overview tab have been converted from their payment currency to the display currency. For the Details tab, the application uses costs already converted to the budget currency from their payment currency, and converts them to the display currency. Because costs on the Details tab have an extra conversion, the rounding of decimal places when applying conversion rates can impact costs on the Details tab more than costs on the Overview tab. |

See Also

Real Property / Leases / Reports Overview

Archibus SaaS / Leases / Lease Reports

Area Calculations for Lease Reports