Real Property / Leases / Lease Portfolio / Extension for Lease Accounting

Concept: Right-of-Use Options and Lease Classification

Right-of-use options are agreements written into the lease, such as the right to expand into more space, the right to own the asset at the end of the lease, the right to terminate the lease early, and so on. Right-of-use options have financial implications and so must be considered when classifying a lease.

Reasonably Certain Execution

Right-of-use options outline situations that might occur. Therefore, in order to include them in lease calculations, you must make a determination if they are "reasonably certain" to be executed. For example, suppose your lease includes an option to extend the lease, and your organization is highly likely to extend the lease because you need the space and the economic terms of the lease are favorable with respect to the market rate for similar space. In that case, your organization is “reasonably certain” to execute that option.

Similarly, suppose your organization has an option to buy an asset – such as a leased piece of equipment – and that option costs less than the residual value of the equipment item at the end of the lease. In this case, your organization is “reasonably certain” to execute the option to buy.

The Lease Options table contains the Is Reasonably Certain? field so that you can specify the likelihood of an option being exercised.

When the Reasonably Certain? field is set to Yes, the Lease Classification Wizard includes both the cost and the term in its analysis.

- Cost. If an option for a lease is reasonably certain, the present value of the costs for that option are included when calculating the ROU Asset and Initial Lease Liability. For instance, if a lease extension is reasonably certain to be executed, the present value of each of the lease payments is included in the ROU Asset and the Lease Liability. If an option to buy is reasonably certain to be executed, the present value of the option to buy is included in the ROU Asset and the Initial Lease Liability.

- Term. If an option for a lease is reasonably certain, the term of that option is also included in the classification of the lease. For instance, if an organization is reasonably likely to execute an option to extend a lease for another five years, those five years are added to the likely term of the lease and included in the amortization schedule.

Therefore, if circumstances about a reasonably-certain option change, that change needs to be considered in the classification analysis. Likewise, if a right-of-use option becomes reasonably certain, it must be considered in the analysis.

So that you can conveniently access your right-of-use options and update them if they become certain, the Lease Classification Wizard offers the Step 3 tab. From this tab, you can edit right-of-use options for the lease that have been exercised, or are very likely to be exercised. Typically, you already entered these options using the Lease Portfolio Console and are updating from the Step 3 tab. From the Step 3 tab, you can also enter right-of-use options that may have developed since the lease was first entered.

Entering Right-of-Use Options

Right-of-use options are stored in the Lease Options table. Enter your right-of use options with these methods:

- Enter options using Lease Portfolio Console.

- When running the Wizard to classify a lease, use the Wizard's Step 3 tab to enter new lease options that have come up, or enter changes to existing options.

For information see:

- Entering your Leases and Lease Options with the Lease Portfolio Console

- Entering ROU Adjustments (Lease Classification Wizard)

The following types of lease options affect classification. When you make changes to options of these types using the Lease Portfolio Console, the system automatically submits the lease for re-evaluation.

- EXPANSION

- CONTRACTION

- RENEW LONGER TERM

- AUTOMATIC TRANSFER OF OWNERSHIP

- EARLY TERMINATION

- OPTION TO BUY

- IMPROVEMENTS

Updating Right-of-Use Options

There are two main reasons to update right-of-use options when classifying leases.

To document changes to a lease

Sometimes lease conditions change in the middle of a lease and these changes may require that you work through the questions to reclassify the lease. If your financial obligation changes, you must restate your lease obligation from the date you recognize the change to the end of the term. For example, suppose you used the Wizard six months ago to classify a lease. However, circumstances at your site have just changed and your company has decided to exercise an option to expand the leased space. In this case, you would return to the Classification Wizard, select the Re-Evaluate option, and access Step 3 tab so that you can enter the expansion as an option and have the Wizard recalculate the values.

Reduce the Ratio of Initial Liability Over Fair Market Value

A common use case for revisiting your right-of-use options is to reduce the value of the Ratio of Initial Liability Over Fair Market Value of the Asset. When you work through the Wizard's Step 2 tab, the system calculates this value. If this value is less than 90 percent, you have an operating lease. If the value is over 90 percent, you have a finance lease. However, you might be able to reduce this value by including right-of-use options.

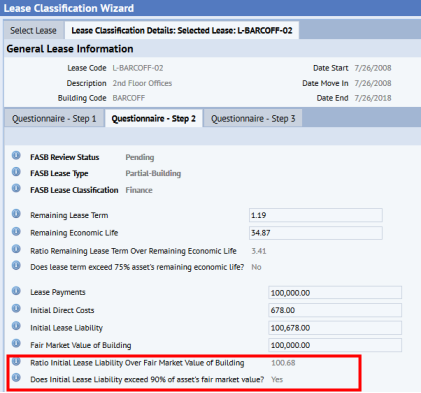

For example, in the below image, the Wizard has determined that the liability is over 90 percent of the value; it is 100.68 percent of the value. When you choose the Step 2 Done button, the Wizard moves to the Step 3 tab so that you can examine your existing right-to-use options to make sure you have included everything. Perhaps upon reviewing the options, you can make a change that will reduce the ratio to below 90 percent. For example, if you have incurred a penalty for early termination of the lease and have not yet entered it in the system, the penalty can be counted against the liability and might reduce the percentage.

A lease modification may change not just the reporting for the fiscal periods going forward, but can also require stating a change from previously reported periods. For instance, suppose your organization unexpectedly terminates a lease. In reporting, the organization must adjust the ROU Asset and Lease Liability values as well as declare any gain or loss. Reclassifying the lease with the Lease Classification Wizard records the approved lease information before the modification and the approved lease information after the modification.

Examples of Right-of-Use Options

The following examples describe typical right-of-use options and how they are documented in the Lease Options table.

Note that one-time costs are stored in the Options table. For ongoing costs related to right-of-use options, store the costs as Recurring Costs or Scheduled Costs. See Concept: Lease Costs and Option Costs.

In the below examples, the costs are being tracked as one-time costs and are entered in the Options table.

Space Expansion

A building owner reclaimed a former data center of 125,000 square feet (circa 1970), renovated the space into an updated data hub, and occupied the space during 2012. The tenant exercised their option to expand the space in 2017. The renovation project updated the facility adding (75,000 square feet), almost doubling the size of the building at a capital construction cost of $7 million. Approved Capital Funding of $7,000,000 adding 75,000 square feet to the lease.

In this case, you would create an option record with these values:

| Field | Value |

|---|---|

| Lease Option | 001 |

| Option Type | EXPANSION |

| Description | Facility Expansion - 2017 |

| Date Exercised | Jan-30, 2017 |

| Cost- Estimated | $ 7,000,000 |

Space Contraction

| Field | Value |

|---|---|

| Lease Option | 001 |

| Option Type | CONTRACTION |

| Description | Facility Consolidation - 2017 |

| Date Exercised | March 30, 2017 |

| Cost- Estimated | - $347,457.00 |

Lease Extension

You are in the middle of negotiating a new lease, but will not finish negotiations on time. You decide to extend the current lease for another three months while you continue to negotiate. You enter the total cost of the 3-month expansion in the Cost Estimated field.

| Field | Value |

|---|---|

| Lease Option | 001 |

| Option Type | RENEW LONGER TERM |

| Description | 3-month extension to existing lease |

| Date Exercised | January 15, 2017 |

| Cost Estimated | $8,205.00 |

Early Termination of a Lease

One of your business units needed to shut down production unexpectedly. There is 10 percent penalty fee for early termination of the lease. Based on leased rate of $233,865 per year, the tenant's fee is a $23,386.50 one-time payment. This penalty can be added to your costs.

| Field | Value |

|---|---|

| Lease Option | 001 |

| Option Type | EARLY TERMINATION |

| Description | Early Termination - Jan 2017 |

| Date Exercised | January 15, 2017 |

| Cost Estimated | $23,386.50 |

Improvements

A business may want to update their interior every seven years to attract the talent they need.

| Field | Value |

|---|---|

| Lease Option | 001 |

| Option Type | IMPROVEMENTS |

| Description | Interior Renovation-2017 |

| Date Exercised | Feb-15-2017 |

| Cost Estimated | $150,000 |