Archibus SaaS / Assets / Depreciation

Manage Asset Depreciation

Using the Depreciation process, you calculate depreciation for tagged furniture inventories and equipment inventories, and generate reports that analyze asset financial information. For each furniture and equipment item, you can check its current value, depreciation cost for particular periods, and accumulated depreciation.

In order to generate depreciation data for an asset, you must associate a depreciation method and a depreciation period with the asset. Rather than assign this information to each asset, you develop depreciation property types that define depreciation methods and periods, and then assign a depreciation property type to each tagged furniture and equipment asset.

You can work with depreciation from both Web Central and Smart Client.

- From the Assets module, you use Web forms to develop and update your depreciation data, such as depreciation logs and depreciation property types, and to assign property types to your furniture and equipment assets. These Web forms includes drill-down selection lists and the Smart Search console to facilitate locating specific equipment and tagged furniture records.

- The Smart Client provides grid views for these same tasks. Grid views are the most efficient way to work when performing bulk data entry or updates.

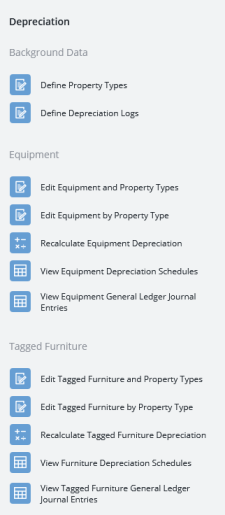

The Assets / Depreciation process offers these tasks:

Procedure

Prerequisite: Develop a tagged furniture inventory and/or an equipment inventory.

- Review the Depreciation Concepts so that you understand the depreciation methods that are supported.

- Define depreciation logs, which document the monthly periods for which you calculate depreciation costs

- Define depreciation property types and their associated depreciation methods.

- Assign depreciation property types to equipment assets and tagged furniture assets. This determines how depreciation will be calculated for each asset

- Ensure that each equipment or tagged furniture record has the data required for calculating depreciation; that is to say, the values for the Purchase Price, Salvage Value, Install Date for equipment, Delivery Date for furniture are completed.

- See:

- Calculate depreciation:

- Analyze depreciation and costs with depreciation reports.

See Also

Depreciation business functions