Getting Results with Archibus

Chargeback & Invoicing

Per the particular details of their lease agreements, property owners often charge tenants for expenses they incur, such as leasehold improvements, property maintenance, and security. For example, if a landlord builds a fitness center on the property for tenant use, the landlord will pass this cost onto the building tenants in proportion to the amount of space that each tenant occupies. The process of proportionately distributing lease-related and property-related costs among the appropriate parties according to the amount of area they occupy is known as chargeback.

Typically the tenant, in turn, passes the chargeback costs they receive along to organizational entities within their company -- their divisions and departments -- through internal chargeback.

Once property and lease costs are entered through the domain's Costs application, financial staff can use the Chargeback & Invoicing application to proportionately distribute these costs, bill for the costs that are receivables, and then manage the payments received from these bills. As the domain's cost system works for property owners renting out space, tenants leasing space, or companies owning and occupying their buildings, the chargeback system accommodates these situations by distributing costs according to lease, department, building, property, or account.

This application includes two wizards that facilitate data entry and reduce errors:

- The Chargeback Cost Wizard guides you through the process of generating chargeback, viewing any exceptions, and approving the chargeback costs.

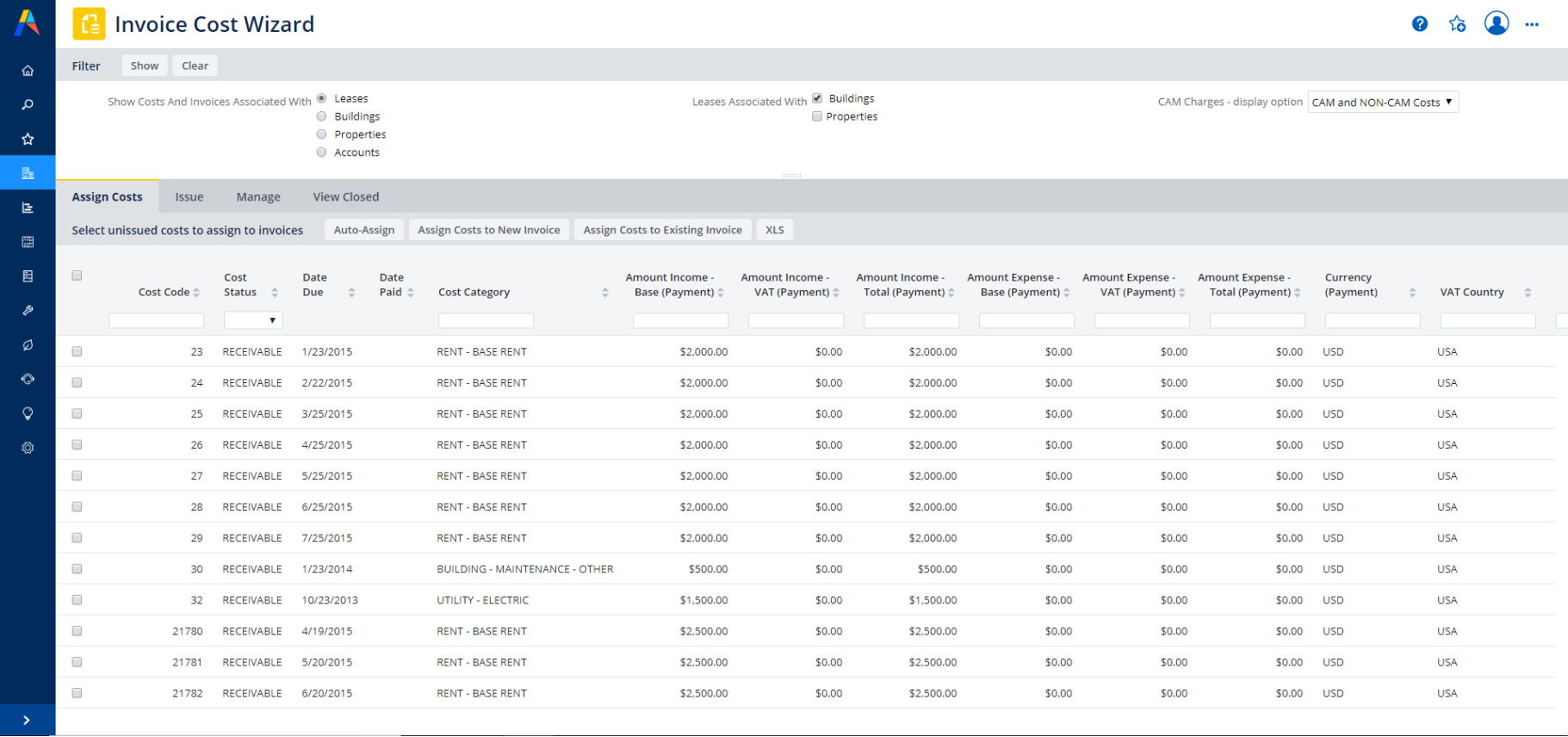

- The Invoice Wizard enables you to associate costs with invoices, issue invoices, and manage payments and prepayments.

|

Chargeback & Invoicing |

|

|---|---|

|

Location |

Archibus non-SaaS

Archibus SaaS

|

|

Business Result |

Financial chargeback system (including direct billing) for landlords to charge tenants for expenses, and for tenants to pass along these expenses to their departments. Greater awareness of property and lease expenses, and thereby improvements in efficiency, because costs are passed onto tenants or internally to departments. Improved cash flow through automated billing and payment tracking of property and lease costs. Reduced errors and administrative overhead by using the Chargeback Cost Wizard to generate chargeback, and the Invoice Cost Wizard to issue invoices and track payments. |

|

Used By |

Lease Administrators Financial Managers Accounting Staff |

|

Reasons for Automating |

To prorate and charge back property and lease- related costs through an automated system and a wizard interface that guides you through the process. To bill the appropriate parties for the charged back costs through electronically-generated invoices. To manage the income received from invoiced costs using a wizard interface. To store all chargeback, payable, and receivable lease and property cost data in a central repository where it can be accessed by all key stakeholders over the network. |

|

Prerequisite Applications |

|

|

Results/Reports

|

Actual Costs by Lease, Building, Property, Account, or Department Invoice Details (cost and payment details by invoice) Accounts Receivable Invoices for Leases, Buildings, Properties, or Accounts Lease Chargeback Agreements Prepayments |

|

Applications Using Results of this Application |

None. |

The following are typical users:

|

User |

Tasks |

|---|---|

|

Business Process Owner |

Selects the lease area methods. The system uses this information to base the calculation for costs that depend on measured areas on either suites, groups, or rooms. Defines lease chargeback agreements. Approves generated chargeback costs. Monitors chargeback, invoice, and payment system for lease and property costs. |

|

Lease Administrator |

Charges back property and lease expenses. Creates and issues invoices for property and lease costs. Applies payments to property and lease invoices. Manages prepayments and applies them to invoices. |