Getting Results with Archibus

Strategic Financial Analysis

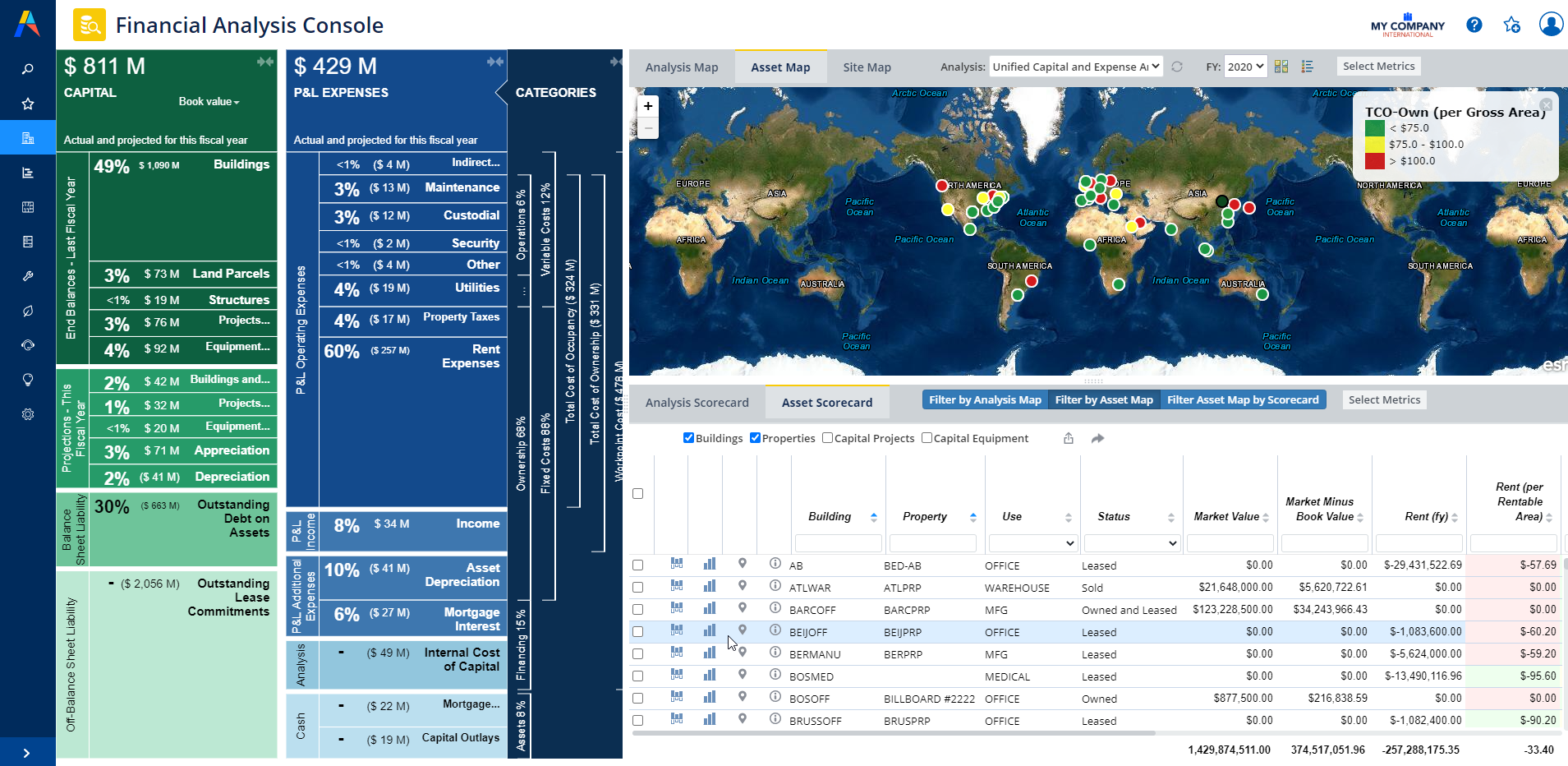

The Strategic Financial Analysis application provides a unified view of your real estate, infrastructure and facilities assets, all capital and expense costs they incur, and all the organization missions they support. The application also provides a common operating picture so that different roles can communicate the impact and importance of spending and investment – finance professionals, capital planners, real estate and facility directors, and operational managers can all understand how the work they do interacts and how they can work better together in concert.

The application gives visibility into the one-third of your organization's balance sheet that manages fixed assets. It helps ensure that the investment in these assets is efficiently deployed to drive the organization's mission forward.

Unlike point solutions for capital planning, real estate and facilities management, Strategic Financial Analysis captures the total costs of ownership and operations and their interrelations. And unlike ERP systems acting alone, it connects all costs to the locations of your business units thereby expressing the value of that spend to the mission.

|

Strategic Financial Analysis |

|

|---|---|

|

Location |

Archibus non-SaaS:

Archibus SaaS:

|

| Also known as |

Total Cost of Ownership Totex Analysis Lifecycle Costing |

|

Business Result |

Aligns assets, capital plans, and expenses towards mission goals. Explains rationale for strategic decisions. Uses benchmarks and targets to identify outliers, reduce waste, and defend budgets. |

|

Used By |

Capital Planner Cost Analyst Portfolio Manager Finance Manager Real Estate Director Facility Director |

|

Reasons for Automating |

Summarize operational and capital expenses for buildings and business units Estimate the total cost of occupancy – that is all real estate, infrastructure and facility expenses Estimate the total cost of ownership – that is all expenses plus all depreciation of multi-year investments Estimate the workpoint cost – that is the total cost of ownership plus the cost of financing and opportunity Calculate metrics that scale the costs per seat and per sqft or sqM Benchmark yearly costs against organizational targets to find outliers Benchmark lifecycle costs and benefits of a facility to compare cost/benefit of different building and capital project investments Compare these metrics and benchmarks against measures of the performance of the real estate and infrastructure, including FCI, vacancy, and mission criticality Locate these metrics and costs geographically, and include them in the same view as the capital invested in building, structures, land and equipment assets Coordinate the financial point of view of different stakeholders, as they come to the unified picture of finances from a real estate, capital, operations or financing perspective |

|

Contributing Applications |

Strategic Financial Analysis automatically merges the detailed inventory, expenses, and projections from each operational process. The following applications can contribute to your analysis:

|

|

Results and

|

Total Cost of Ownership (TCO) analysis "TotEx" analysis Total Cost of Occupancy analysis Total Workpoint Cost analysis Lifecycle Cost analysis NPV and IRR analyses Unified view of Assets, Capital, and Expenses |

The following are users of the Strategic Financial Analysis application:

|

User |

Tasks |

|---|---|

|

Capital Planner |

Compare multiple capital projects with substantially different purposes (e.g. energy remediation versus new building). Evaluate investments that incur both capital costs and operational expenses. Provide "apples-to-apples" alignment of capital through an integrated analysis of both capital and costs. |

|

Portfolio Manager |

Quantify and justify the mission benefit of capital and cost decisions. Measure how assets and operational spend best support the mission while mapping costs to accounting practices for the P&L and balance sheet. Perform a yearly review of each property to ensure it meets optimization criteria. Align capital to mission through increased understanding of how each part of the portfolio supports the business. Approve and execute capital plans by connecting them to the financial drivers needed to achieve them and the financial results that will accrue. Reduce costs and improve return on assets through close alignment of the assets, capital, costs, and risks with the business they support. |

|

Facilities Director |

Justify budgets, eliminate waste, and verify that spending on controllable costs is within industry benchmarks. Preform a yearly review of operational costs for each building. Lower costs by identifying and resolving outliers, inefficient equipment, buildings, and suppliers. Approve budgets faster l by providing real cost context for budget choices. Identify and learn from outliers with exemplary performance. |

| Finance Manager | Analyze how real estate, infrastructure, and facility capital usage and expenses map to financial concerns. |

| Real Estate Director |

Explain the difference that the IFRS and FASB rules on lease accounting will change the cost analysis on the portfolio. Present to senior leadership how the capital tied up in assets and how the yearly operating budget directly supports the mission of the organization. Present the financial context for proposals to buy or sell buildings or properties. Compare total cost for leased and owned spaces on an even basis to make buy/lease decisions. Compare total cost for buildings independent of the decisions for financing the buildings. |

| Lease Manager | Compare different leases on an even basis. |

| Cost Analyst |

Analyze total cost of providing the real estate, infrastructure and facility inclusive of cost of financing and capital. Determine the proper value to use for internal chargeback of space. |

| Operations Manager | Benchmark operations costs against targets. Defend categories of the operations budget. |

| Energy Manager | Identify buildings that are prime candidates for energy remediation capital projects. |

| Asset Manager | Explain to senior leadership the return on their investment in real estate, infrastructure, and facility assets. |

See also